Choosing someone to name in your Estate Plan to serve as your Executor, Trustee and Agent under Power of Attorney can be a daunting task. Who should you name? There are many options to choose from, such as a Professional Fiduciary, your attorney, your CPA, a Bank Officer, a family member or a friend. Here I will review your various options and why choosing a Professional Fiduciary may be a superior choice. Why you may want to name a Private Professional Fiduciary instead of a Bank Trust Officer... Ease of Transition – Bank Trust Offices are huge departments that are often difficult to get through to. This may not come into play as much while you are living and serving as your own trustee, however, once you pass away, beneficiaries can find it difficult to get through to Trust departments to notify them of your passing and that the Bank is the named Successor Trustee. Trust Officers will not be proactive in seeking out the trust documentation that names them Trustee. They will simply wait to receive a copy of the trust, often for weeks or months after your passing. This delay could leave your assets (think home and contents, or bank accounts with auto-pays that could cause over drafting) at risk during the interim period while there is no acting trustee. Often the bank has no idea they are the trustee until someone notifies them, which can be a difficult task for a beneficiary who does not understand the legal terminology (a will verses a trust, or a trustee verses a trustor, or a fiduciary verses an attorney – all often confused). Beneficiaries often do not understand their rights or role as the beneficiary or the trust administration process itself. Personal Service – Bank Officers may or may not give your beneficiary a direct line to contact them. Often a beneficiary will have to call into the call center and be transferred through to the Trust Officer each time they call. With a Professional Fiduciary, your beneficiary has a direct number to contact the trustee. They will also have the same point of contact and often, depending on the size of the Fiduciary Firm, be able to speak directly with the trustee. Professional Fiduciaries can be easier to get a hold of and they can provide more personal service. Further, a Professional Fiduciary is able to customize their administration to each and every trust matter. Trust Officers are often bound by bank protocol and routine procedure which may not meet each individual beneficiary’s needs. Handling Non-Cash Assets – If you have an estate that is composed of checking, savings and investment accounts, a Bank Officer may be suitable for your needs. However, if you own a home, investment properties, vehicles, boats, furniture and furnishings inside a home or in storage, a Bank Officer may not be the best choice. Bank Officers want to manage money for the most part. They typically do not want to handle the sale or distribution of your non-cash assets or manage life estates or rental properties. Often times upon finding out that there are these types of assets in the trust, they will decline to serve and the next named trustee will need to step up. If you have these types of assets, it may be a better choice to name a Professional Fiduciary as your Executor and Successor Trustee. Further, a Professional Fiduciary is usually willing to serve as Agent Under Power of Attorney, while Bank Officers will not. Account Minimums – Bank Trust Departments have account minimums and will not take on smaller trust administrations. A typical bank minimum is $5 million in cash and investment accounts. You may be able to find smaller Banks that have a lower minimum. A Professional Fiduciary sets their own minimum and accepts new matters on a case-by-case basis. Why you may want to name a Private Professional Fiduciary instead of an Attorney or CPA... Not Their Expertise - Attorneys typically do not want to administer trusts or estates. Attorneys want to practice law by drafting pleadings and petitions and provide legal advice to their clients. Attorneys are experts in their field of law. Similarly, CPA’s like crunching numbers and giving tax advice. Attorneys and CPAs do not know the day-to-day administrative steps, procedures or the practical application of trust and probate law. As Professional Fiduciaries, we are experts in administration. On a daily basis, we deal with collecting accounts, managing investments and rental properties, filing tax returns, making distributions to beneficiaries, appraising assets, completing fiduciary accountings (which many CPAs do not know how to do and many attorneys will outsource), and more! Did Somebody Say Billable Hours? – “Billable hours” is a common term for attorneys, CPAs and fiduciaries alike. We all bill by the hour on certain matters and have hourly rates. Attorneys and CPAs will often bill at rates between $275-600 per hour. While Professional Fiduciary rates are typically seen under $275 per hour. Utilizing a Professional Fiduciary is usually much more cost effective than utilizing an attorney or CPA for trust administration. Conflict of Interest – I frequently hear of drafting attorneys who refuse to name themselves as a successor trustee in the Trust they are drafting. Firstly, because they do not want to administer trusts, and, secondly, because there is an inherent conflict of interest in doing so. The drafting attorney, knowing that they are the named successor trustee, can draft the trust agreement in such a way that is more friendly toward the trustee’s interests and less friendly toward the beneficiaries’ interests. Likewise, a CPA, knowing your financials inside and out could coach you into making financial decisions that may be more beneficial for their anticipated role as trustee, rather than what is most beneficial for you here and now. Further, if your CPA is administering your estate, filing fiduciary tax returns and producing the fiduciary accounting all by themself, there is a lack of checks and balances, which can encourage misdealing. Why you may want to name a Private Professional Fiduciary instead of a family member or friend... Experience – Professional Fiduciaries wear many hats and there are a lot of moving parts in trust and estate administration that you need to be familiar with. Family members and friends, no matter how smart or well educated, do not know how to administer a trust or estate and often take missteps, make mistakes, create costly errors or are negligent in their duties. Negligence by a family member serving as trustee is the number one factor leading to probate and trust litigation lawsuits. Neutrality – Professional Fiduciaries are neutral. We are required to treat each beneficiary equally. Family trustees can be emotional and preferential towards themselves or other beneficiaries. Further, if your family trustee is also a beneficiary, this creates an automatic conflict of interest and puts the other beneficiaries on higher guard and your trustee in higher scrutiny. This can lead to more conflict. A Burdensome Task - Ask any family trustee who has administered their loved one’s trust or estate and they will tell you how much work it is! This can be difficult for someone who is working full-time, has a family or is aged themself. When you ask someone to serve as your Executor or Trustee, you must realize that you are asking them to devote at least a full year of their life to the process. Administering trusts and estates is time consuming, stressful and not for the faint of heart. Your family member or friend may not mind taking on the task in exchange for compensation. However, if you expect your family member or friend to serve without compensation, please know the extent of the favor you are asking of them. In addition to the time burden, you are also asking them to take on a significant amount of liability and stress. If you suspect there will be any conflict among your beneficiaries or if your children have difficult or strong personalities, you may want to choose a Professional Fiduciary as your Executor or Trustee. Don’t Forget the Bond – A bond is like an insurance policy on your assets should your Trustee or Executor abscond with your money or act negligently. You can waive the bond requirement in your revocable trust, however, if there’s any inkling that there may be conflict you may want to consider otherwise. Consult with your attorney about this. Any trust administration that goes to court will require a bond. Probate administrations also require a bond. If your named Executor or Trustee is not credit worthy they will not qualify for a bond. Professional Fiduciaries are often appointed because the family members or named Executor/Trustee cannot qualify for a bond themselves. I am not a lawyer and the information contained in this article should not be construed as legal advice.

0 Comments

I’m in my mid-thirties, something that is rare in the Professional Fiduciary community. We have a running joke in our profession that the typical Fiduciary is a middle-aged to semi-retired woman, on her second career. While that’s not entirely true, it is true that many Fiduciaries are almost as old as the clients they serve and nearing retirement, themselves.

Why are there so few young Fiduciaries in this profession, you may ask? Well, I can only speculate and say based off my observations, but I’d venture to say, in general, that young people simply don’t know about the profession. The Professional Fiduciary business community is very small. The Professional Fiduciaries Bureau of California has issued less than 1,500 licenses since its inception. That’s for the entire state of California! Contrast that to the hundreds of thousands of real estate, accountancy, attorney or other professional licenses issued by the state and you can see just how small our community is. Another reason for the lack of younger Fiduciaries may be that, generally, young people just aren’t as qualified to serve as Fiduciaries. I don’t know of a single Fiduciary that graduated college and immediately obtained their Fiduciary license. This is because they simply don’t have the prerequisite knowledge and work experience needed to navigate the wide ranging and complex areas of financial and health care management. As Fiduciaries, we wear many hats and must be proficient in or possess a basic understanding of many fields, such as financial management, investing, estate planning, legal terminology, trust and estate administration, local court rules, the probate code, taxation, understanding fiduciary duty and liability, real estate transactions and tenancy laws, record keeping, accounting and bookkeeping, ethics, public benefits, health care management, interacting with difficult personalities, understanding mental health issues and incapacity and so, so much more. This profession requires such a diverse skill set to really excel. This is why many people become Fiduciaries as a second career and through their association with other Professional Fiduciaries. After they’ve acquired a certain amount of life experience, knowledge and mastery of their own career field, they venture into being a Fiduciary later on in life. Many other lay people experience the need for a Professional Fiduciary because a loved one has passed away and they are named as Trustee or Executor in their family member’s estate plan. Through this “trial by fire,” they gain first hand experience of the profession and move onto becoming Fiduciaries themselves. How ever one eventually becomes a Fiduciary, the common theme among them, is that they all want to help people. With that being said, because Fiduciary work is often a second career for many older people, their previous career experience may or may not alway translate into the necessary skills for success. I remember, when I first became licensed, and had a meeting with a potential client of a multi-million dollar estate. He was actively seeking a young Fiduciary to name in his estate plan but during the meeting he questioned whether he could trust a 30-something year old to manage his life’s work. This resonated with me and, frankly, I’m not sure I would trust the average 20 or 30 year old with my estate either! Nonetheless, I've had an overwhelmingly positive response from people who value my know-how more than my age. Since then I’ve been appointed as Trustee, Conservator and Administrator of many different types of estates ranging from $300,000 to several million dollars. Though I’m younger, I’ve been working in the trusts and estates legal field since I was 19 years old and this experience has created a sound bedrock of knowledge and has contributed to my success as a Fiduciary. I receive a lot of referrals for new matters due to my younger age, and I would like to think, also, because of the reputation I’ve built up in the Fiduciary and Legal communities for being capable and knowledgeable in Trust and Estates administration. Many people seek out and, likewise, attorneys recommend a younger Fiduciary to be named in their client’s estate plan because it just make sense. Statistically speaking, you’re more likely to pass away (or decline health-wise) before someone that is younger than yourself. Naming a Fiduciary that is similarly aged to yourself may result in that Fiduciary retiring or passing away first. This can result in the Court becoming involved to appoint a Fiduciary to handle your affairs because there is a vacancy in that position. One major goal of a good estate plan is to avoid court involvement altogether. So be sure to interview and really consider all aspects of the Fiduciary’s experience and longevity before you decide to name him or her in your estate plan. If you’re seeking a Fiduciary to name in your estate plan, please contact me to set up a meeting! I am not a lawyer and the information contained in this article should not be construed as legal advice.  COVID-19 Virus COVID-19 Virus It goes without saying that elderly people should have an estate plan in place that plans for incapacity and death, and the eventual distribution of their estate. However, if you are a “younger” person reading this (under age 60) and do not have an estate plan, then I highly suggest you contact an attorney immediately to draft one up. For small estates, your attorney may determine you need only a simple Will and Power of Attorney documents. If you have very little assets but are a parent of minor children you still need a Will to appoint a Guardian for your minor children should anything happen to you. For more moderate to high wealth estates, you may need a more comprehensive Trust and estate plan. Regardless of anyones age or financial status, everyone should have current Power of Attorney documents naming an Agent (or Agents) to act on their behalf for financial and health care decision-making, in the event they cannot do so themselves. If you need a referral to an estate planning attorney, please give me a call! In all the years I’ve worked in the area of trusts and estates, whether as a paralegal or a Professional Fiduciary, there’s nothing more heartbreaking than a young person experiencing a catastrophic event and no longer being able to care for his or her own needs. Even sadder, is when that person has a family and young children. When we’re young, we like to think we will live forever and the thought that we may no longer be able to take care of ourselves at some point doesn’t even cross our minds. That period of time between being healthy and death is often overlooked. There can be years of physical incapability and mental incapacity. This period of time is why it’s essential to have Power of Attorney documents in place. Young people are not invincible to accidents or health issues and one of the best ways we can protect our families is to plan ahead, so they are not left scrambling, should this occur. Well drafted Power of Attorney documents will avoid the need for costly and often slow to implement Conservatorships. A Power of Attorney can be effective as of its date of execution or it can be “springing” meaning it becomes effective only upon a qualifying event. This qualifying event is usually the medical diagnosis of mental incapacity by two independent doctors stating your inability to make your own financial or health care decisions. With a Power of Attorney your Agent can act on your behalf almost immediately. Without Powers of Attorney, your family members will have to Petition the Court for Conservatorship of the Estate (to manage your finances) and Conservatorship of the Person (to manage your healthcare). This court involvement is cumbersome and because it involves a hefty Conservatorship paperwork package to be drawn up by an attorney it can more quickly deplete yours or your family’s financial resources. Furthermore, Conservatorships are court supervised during the entire course of their establishment and they require ongoing petitions, paperwork and accountings to be completed and filed by attorneys, further depleting financial resources. If you do not have a trusted family member or friend, or do not want to burden them with the responsibility, you can name a Professional Fiduciary in your Power of Attorney documents. Please contact me to discuss potentially naming me as your Financial or Health Care Agent in your Power of Attorney documents, and if you’re executing a Will or Trust, naming me as your Executor or Trustee, as well. I am not a lawyer and the information contained in this article should not be construed as legal advice. On Wednesday, December 11th, I joined the Professional Fiduciary Association of California (PFAC) at St. Paul's Villa to sing Christmas Carols for the residents there. St. Paul's Villa is an Assisted Living and Memory Care facility for seniors, located in Banker's Hill. Approximately 30 fiduciaries and affiliated PFAC members, joined together in song to invite the Christmas Spirit to St. Paul's. The residents sang along and danced in their seat.

In addition to caroling, we brought homemade and store bought treats to share. In speaking, with some of the residents afterwards, they expressed their sincere thanks and appreciation for the event and the delicious cookies! One resident said my cookies were so good, I should enter them into a baking competition! The event was a blessing to all in attendance and it was our joy to bring joy to these sweet souls! Probate Prom is one of my favorite probate events of the year. It’s an event where probate attorneys and estate planning professionals can gather together for an evening of fun conversations, dinner and dancing. The theme this year was “The 80’s” and I donned an 80’s Working Girl look, complete with big, frizzy hair! This year was my 4th year attending and I was graciously invited to sit with Brierton, Jones & Jones’ table. Jerilyn Jones was honored with the Probate Attorney of the Year Award for her more than 30 years of service in the probate community. It was interesting to hear about how she was a teacher before she became an attorney and all that she’s contributed to our community. It was, also, announced that attorney Judy Bae was just appointed to the bench and is now the Honorable Judge Judy Bae! Speaking of Judges, after years of working in the probate community, I finally shook hands with and met the Honorable Judge Jeffrey Bostwick, one of our 3 San Diego Probate judges. What a fun evening! I had so much fun at this year’s Annual Professional Fiduciary Association of California (PFAC) Education Conference in Anaheim, CA. Not only did I get to rub elbows with some of the finest fiduciaries in the state (and pick their brains), see old friends from last year’s conference and expand my knowledge base, but this year’s conference was at DISNEYLAND!

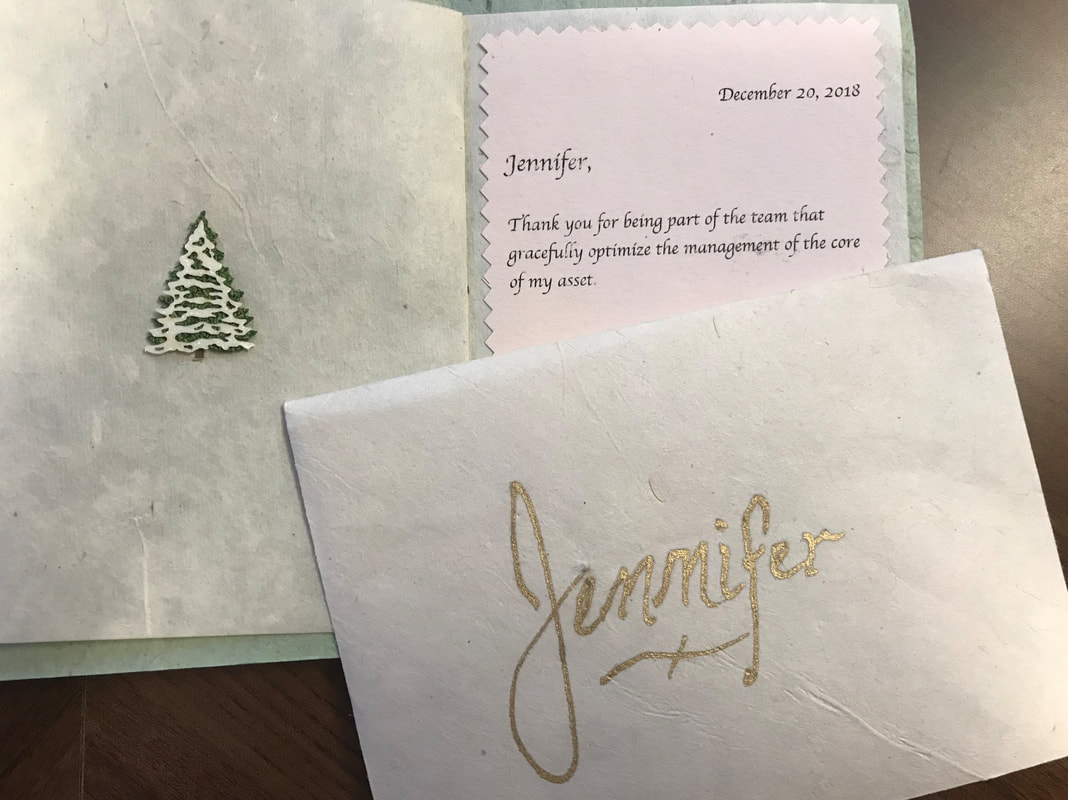

My associate and I took the Amtrak up to Anaheim. It was my first time riding a train and I’m already planning my next train trip. The views of the California coast were beautiful and the ride there and back was relaxing. We stayed at the beautiful Disneyland Resort. This year’s conference sessions included topics relating to the handling of tangible personal property, cyber-security, Special Needs Trust administration, the Regional Center and the CalAble Act, mental illness, estate taxation and ethics. Between conference sessions, we were able to visit Downtown Disney and California Adventure, to catch the World of Color lights and water show. I won a plush Mickey Mouse stuffy and my daughter was very excited to receive Mickey to complete her mouse family. Next year’s PFAC Education Conference is in San Francisco! Can’t wait! The holidays have a way of prompting you to consider what truly matters in life...

This Christmas, I find myself so grateful for my family, friends, colleagues and, of course, our clients. I'm proud to be a part of a wonderful team that truly makes a difference in people's lives. Thank you for the confidence you've placed in our office! Merry Christmas and a Happy New Year from Jennifer Feehan! P.S. I love receiving this type of "correspondence" from clients! Little notes of appreciation such as this mean more to us than words can express! I attended the Probate Attorneys of San Diego (PASD) Annual Probate Prom last Friday, October 26th. This year's theme was Disco! Hundreds of attorneys and other estate planning professionals disco danced the night away to the tunes of Those Radio Thieves. The highlight of the evening was when Probate Judge Julia Kelety surprised us with her participation in a choreographed disco dance! Thank you to PASD and event sponsor Hearthstone Private Wealth Management for a wonderful evening!  The Hearthstone Private Wealth Management table! A great group of attorneys, CPAs, fiduciaries and investment professionals! Jennifer Feehan and Rob Dieringer

Saturday, October 20th was a beautiful, sunny day and perfect for a stroll through Balboa Park. Team LEAD4theCure (pictured below) helped raised $14,000 for Alzheimer's San Diego, while enjoying the company of fellow colleagues. Thank you to everyone who contributed to this cause!

|

AuthorJennifer Feehan is a California Licensed Professional Fiduciary, serving all of San Diego County Archives

April 2022

Categories

|

RSS Feed

RSS Feed